Buying vs Starting a Cleaning Business: What You Need to Know

Entering the cleaning industry offers entrepreneurs multiple pathways to business ownership. Whether you’re contemplating buying an existing cleaning business with established clients or investing in a commercial cleaning franchise, this comprehensive guide explores the key considerations, costs, and strategies for success. The cleaning service sector continues to demonstrate remarkable resilience and profitability, making it an attractive option for both experienced business owners and newcomers seeking stable cash flow. Understanding the differences between acquiring an established operation versus starting a cleaning business from scratch will help you make an informed decision that aligns with your entrepreneurial goals.

Is Buying a Cleaning Business a Good Investment?

Understanding the Cleaning Industry Profitability

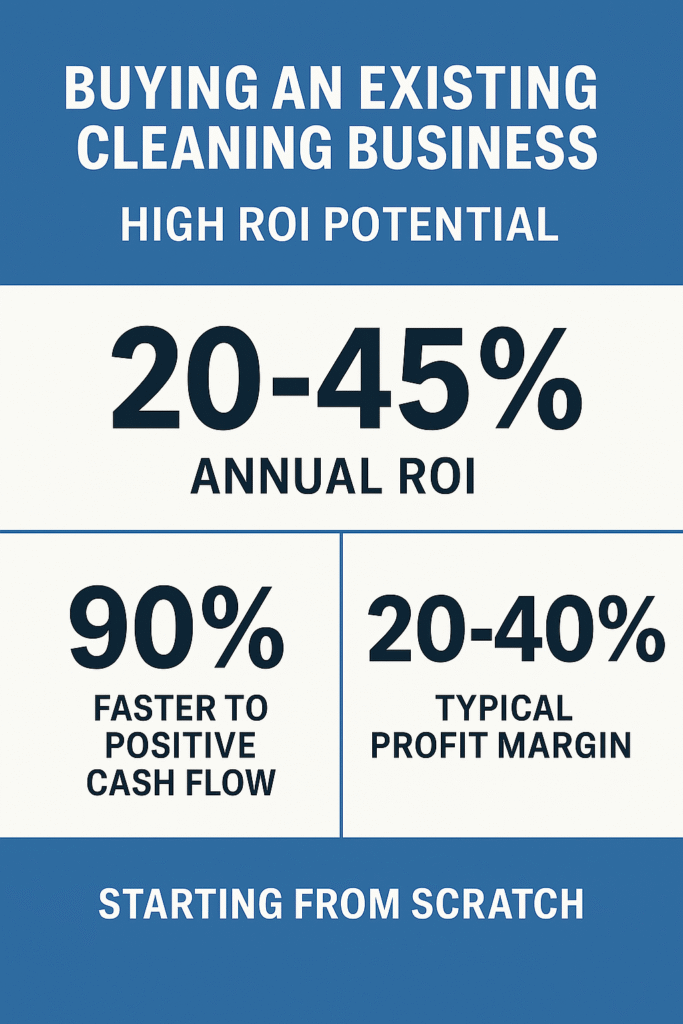

The cleaning industry consistently demonstrates strong profitability metrics that attract savvy investors looking for reliable business opportunities. Commercial cleaning services in particular offer recurring revenue streams through contractual agreements with businesses, commercial properties, and institutions that require regular maintenance. Unlike many other service businesses, cleaning companies typically enjoy lower overhead costs while maintaining healthy profit margins. The essential nature of cleanliness in commercial and residential settings ensures steady demand regardless of economic fluctuations. Many successful business owners report return-on-investment figures between 20-45% annually, with janitorial services for commercial properties often performing at the higher end of this spectrum.

Another compelling aspect of cleaning business profitability is the scalability factor that allows for significant growth potential. As a cleaning service establishes its reputation and brand recognition, expansion opportunities emerge through adding specialized services like carpet cleaning or focusing on niche markets such as medical facilities or educational institutions. The recurring revenue model creates predictable cash flow patterns that facilitate better business planning and financing options. Industry data indicates that established cleaning businesses with proper management systems typically achieve profit margins between 20-40% after accounting for supplies, equipment, payroll, and administrative costs. This profitability profile, combined with relatively low barriers to entry, positions the cleaning industry as an attractive investment vehicle for entrepreneurs seeking sustainable business models.

Comparing ROI: Existing Cleaning Business vs Starting from Scratch

When evaluating ROI potential, buying an existing cleaning business offers immediate advantages compared to launching a cleaning company from scratch. An established operation comes with existing clients, proven systems, and demonstrable cash flow – eliminating the challenging startup phase where new businesses struggle to build a customer base. The valuation of an existing cleaning service typically reflects its current client contracts, equipment assets, and historical profitability, providing tangible metrics for calculating potential returns. Business owners who purchase established operations can often recoup their investment 90 percent faster since they’re not spending months or years building brand recognition and client relationships from zero.

Starting a cleaning business from scratch, while offering lower initial investment costs, typically requires significantly more time before achieving comparable profitability. New cleaning companies must invest heavily in marketing, equipment purchases, and establishing operational protocols without guaranteed revenue to offset these expenses. The ROI timeline extends considerably as you’ll need to develop business relationships, hire and train cleaners, and establish your business name in a potentially crowded marketplace. Statistical industry data suggests that while an existing cleaning business might command a higher asking price, the accelerated path to positive cash flow often justifies this premium for many buyers. Additionally, existing businesses may have valuable intangibles like established vendor relationships, trained staff with cleaning experience, and optimized service routes that would take years to develop independently—all factors that contribute to a more favorable long-term return on investment profile.

Cash Flow Considerations When Buying a Cleaning Service

Cash flow represents one of the most critical factors when evaluating a cleaning business purchase. Unlike many other industries, cleaning services typically generate consistent monthly revenue through service contracts rather than unpredictable one-time transactions. When analyzing an existing cleaning business, examine client payment terms, contract renewal rates, and seasonal fluctuations that might affect liquidity. Commercial cleaning accounts often provide more stable cash flow than residential cleaning since they typically operate with longer-term contracts and higher service frequencies. Prudent buyers should verify that the reported cash flow accurately reflects the business’s financial health by examining at least two years of financial statements.

Beyond reviewing historical cash flow data, potential buyers must consider how transitioning ownership might temporarily disrupt revenue streams. Client contracts may contain change-of-ownership clauses requiring renegotiation, while some customers might reconsider their service needs during the transition period. Effective due diligence includes assessing client concentration risk-if a significant percentage of revenue comes from just a few accounts, cash flow stability becomes more vulnerable. The business’s working capital requirements also merit careful examination, as cleaning operations need sufficient liquidity to cover payroll obligations, supplies and equipment purchases, and insurance premiums before client payments arrive. Establishing proper financial controls and accounting practices immediately after acquisition helps new owners maintain and potentially improve cash flow management while identifying opportunities to enhance profitability through operational efficiencies or service expansion strategies.

How to Find the Right Existing Cleaning Business to Buy?

Types of Cleaning Businesses: Commercial, Residential, and Specialized Services

The cleaning industry encompasses diverse business models, each with unique operational requirements and profitability profiles. Commercial cleaning businesses focus on servicing office buildings, retail spaces, and industrial facilities, typically operating during evening hours with larger teams of cleaners. These operations often secure long-term contracts with predictable revenue streams but may require specialized equipment for handling commercial properties. Residential cleaning services, conversely, primarily serve homeowners and apartment dwellers, operating during daytime hours with emphasis on detail-oriented work in personal living spaces. While residential clients may provide more personal satisfaction through direct appreciation, they typically generate lower per-client revenue than commercial accounts.

Specialized cleaning services represent another category worth consideration, including carpet cleaning businesses, post-construction cleanup services, or disaster restoration companies. These niches often command premium pricing due to the specialized equipment and training required, though they may experience more seasonal or irregular demand patterns. Janitorial services, which blend aspects of commercial cleaning with maintenance responsibilities, represent another prevalent business model within the industry. When selecting which type of cleaning business to acquire, carefully assess your personal preferences regarding working hours, client interactions, and technical complexity. Your existing business experience and comfort level with managing different types of client expectations should guide this decision. Additionally, consider market saturation in your target region—some areas may have oversupplied residential cleaning services while lacking quality commercial cleaning providers, creating opportunities for differentiated positioning within the marketplace.

Evaluating Cleaning Companies for Sale: What to Look For

When evaluating cleaning companies for sale, begin by examining their client portfolio diversity and contract stability. High-quality prospects typically maintain a balanced mix of customer types without dangerous revenue concentration among just a few clients. Review contract terms, renewal rates, and client longevity, as these metrics indicate service satisfaction and business stability. Inspect the condition and age of cleaning equipment and vehicles, as these assets significantly impact operational efficiency and near-term capital expenditure requirements. Sophisticated buyers also analyze workforce composition, including cleaner retention rates, payroll structures, and whether employees classify as W-2 workers or independent contractors-each arrangement carrying different liability and tax implications.

Beyond tangible assets and client relationships, investigate the cleaning business’s reputation within its service area. Online reviews, Better Business Bureau ratings, and industry certifications provide insights into service quality perceptions. The selling owner’s reason for exiting deserves thorough scrutiny—businesses sold due to retirement or personal circumstances may present better opportunities than those facing competitive pressures or regulatory challenges. Request detailed financial records including profit and loss statements, tax returns, and accounts receivable aging reports to verify profitability claims and identify potential collection issues. Evaluate the existing business’s pricing structure relative to market rates to determine whether current profit margins are sustainable or whether the operation relies on below-market pricing that could require adjustment post-acquisition. Finally, assess growth potential by identifying underserved market segments or service expansions the current owner might have overlooked, as these opportunities could significantly enhance the business’s value proposition beyond its current valuation.

Conducting Due Diligence on an Existing Cleaning Business

Thorough due diligence represents the critical foundation for a successful cleaning business acquisition. Begin by verifying all financial statements through an independent accounting review, paying special attention to revenue recognition practices and expense categorization. Request client contracts to confirm their transferability, duration, and special terms that might affect future profitability. Examine payroll records to understand wage structures, overtime patterns, and compliance with labor regulations. Comprehensive due diligence should include physical inspection of all equipment and supplies, matching inventory lists with actual assets while assessing their condition and remaining useful life.

Beyond financial and operational aspects, investigate the existing cleaning business’s legal standing and compliance history. Verify that all business licenses and permits remain current and transferable to new ownership. Research any past or pending litigation, regulatory violations, or insurance claims that might indicate underlying problems or future liability concerns. Review employee records for proper I-9 documentation, worker classification practices, and any outstanding labor disputes. Contact key suppliers to understand credit terms, delivery arrangements, and pricing structures for cleaning products and equipment maintenance. Consider engaging industry-specific consultants to evaluate the business’s operational efficiency and competitive positioning within the local market. Finally, develop a comprehensive transition plan with the current owner, potentially including a consulting period where they remain involved to facilitate client and employee relationships during the ownership change. This structured approach to due diligence mitigates acquisition risks while establishing a solid foundation for successful business transition.

What Should You Know Before Buying a Cleaning Business Franchise?

Top Cleaning Franchise Opportunities: Costs and Benefits

The commercial cleaning franchise landscape offers diverse opportunities with varying investment requirements and support structures. Leading janitorial franchises like Jan-Pro, Jani-King, and ServiceMaster Clean typically require initial investments ranging from $5,000 to $50,000, plus ongoing royalty fees between 4-10% of gross revenue. These established brands provide comprehensive training programs, proprietary cleaning products, and national account acquisition systems that independent operators cannot access. The franchise model significantly reduces the learning curve for new business owners by providing proven operational systems, marketing templates, and technical training for specialized cleaning protocols. Most reputable cleaning franchises also offer territory protection, ensuring franchisees won’t face competition from other operators within the same system.

While franchise opportunities provide valuable brand recognition and operational support, they come with significant financial considerations beyond the initial franchise fee. Prospective franchisees must carefully evaluate the total investment required, including equipment packages, initial supplies, insurance requirements, and working capital needed during the business establishment phase. The franchisor’s financial performance representations deserve particular scrutiny-review Item 19 of the Franchise Disclosure Document to understand revenue and profitability patterns among existing franchisees. Additionally, investigate the franchise system’s growth trajectory and unit economics by speaking directly with current franchisees about their experiences. Quality franchise systems typically demonstrate strong unit-level profitability, high franchisee satisfaction rates, and transparent communication practices. The ideal cleaning franchise balances reasonable startup costs with robust support systems that genuinely enhance your probability of success compared to independent operations. Consider also whether the franchise offers flexibility to develop specialized service offerings or whether strict adherence to standardized service packages might limit your ability to adapt to local market conditions or pursue higher-margin specialty cleaning opportunities.

Franchise vs Independent Business: Which Cleaning Business Model is Better?

Deciding between a cleaning franchise and an independent cleaning business involves weighing distinct advantages and limitations of each model. Franchises offer immediate brand recognition, proven business systems, and ongoing support infrastructure—critical advantages for entrepreneurs lacking cleaning industry experience. New business owners benefit from established training programs, marketing materials, and operational procedures that might take years to develop independently. Franchisors typically negotiate national supplier agreements that provide cost advantages on cleaning products and equipment, while some offer access to national accounts that independent operators couldn’t secure. These structured systems often enable faster scaling and more predictable growth trajectories compared to starting from scratch.

Independent cleaning businesses, while requiring more developmental work, offer unparalleled flexibility and potentially higher profit margins since they avoid ongoing royalty payments. Without franchise fee obligations, independent operators retain complete control over business decisions including service offerings, pricing strategies, and marketing approaches. This autonomy allows nimble adaptation to local market conditions and emerging opportunities without awaiting corporate approval. Independent cleaning company owners maintain complete freedom to establish their unique brand identity and business culture without conforming to standardized protocols. Financial considerations further differentiate these approaches-franchises typically require higher initial investment but may achieve revenue stability faster, while independent operations generally start with lower capital requirements but face longer paths to profitability. The optimal choice ultimately depends on your personal risk tolerance, industry knowledge, financial resources, and entrepreneurial temperament. First-time business owners often benefit from franchise structure, while experienced entrepreneurs or those with cleaning industry background might extract greater value from independent operations.

Understanding Franchise Agreements and Obligations

Franchise agreements represent legally binding contracts that govern every aspect of the franchisor-franchisee relationship, typically extending 5-10 years for cleaning business franchises. These comprehensive documents outline financial obligations including initial franchise fees, ongoing royalty percentages, advertising fund contributions, and renewal terms. Operational requirements typically specify mandatory cleaning products, equipment standards, service protocols, and quality control measures. Most cleaning franchise agreements include territorial provisions defining your exclusive service area while establishing restrictions on competing businesses or servicing clients outside your designated region. Prospective franchisees must thoroughly review these agreements with specialized franchise attorneys before signing, as they contain significant restrictions on business autonomy.

Beyond explicit financial terms, cleaning franchise agreements contain numerous operational obligations and compliance requirements that directly impact daily business management. These typically include adherence to brand standards, mandatory reporting systems, participation in training programs, and submission to periodic quality inspections. Many agreements contain non-compete clauses restricting your ability to operate similar businesses during and after the franchise relationship ends. The franchisor’s rights regarding termination deserve particular scrutiny-understanding under what conditions they can terminate your agreement and what financial remedies exist proves essential for risk assessment. Franchise agreements also specify transfer provisions detailing your rights to sell the business and the franchisor’s approval requirements for new owners. While these agreements necessarily protect the franchisor’s system integrity and brand standards, they significantly constrain entrepreneurial freedom compared to independent operations. Prospective cleaning business franchisees must realistically assess whether they can comfortably operate within these structured parameters or whether independent business ownership better suits their management style and business objectives.

How Much Does It Cost to Buy an Existing Cleaning Business?

Business Valuation Methods for Cleaning Companies

Cleaning businesses typically undergo valuation through several methodologies, with the most common being multiples of annual revenue or earnings. Small to medium residential cleaning companies frequently sell for 1-2 times annual revenue, while established commercial cleaning operations with stable client contracts might command 2-3 times revenue. More sophisticated valuations utilize the Seller’s Discretionary Earnings (SDE) approach, typically applying multiples between 1.5-3 times SDE depending on business maturity, growth trajectory, and client retention rates. SDE calculations include the owner’s salary, benefits, non-essential expenses, and normalized profit, providing a clearer picture of the business’s actual earning potential for new owners.

Asset-based valuation represents another important methodology, particularly relevant for equipment-intensive cleaning operations like carpet cleaning businesses. This approach calculates the fair market value of tangible assets including specialized equipment, vehicles, inventory of cleaning products, and supplies, then adds a premium for intangible assets like client relationships and brand recognition. For larger janitorial services serving commercial properties, buyers might employ Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) multiples ranging from 3-5 times, reflecting the more sophisticated nature of these operations. The appropriate valuation method depends largely on the cleaning business type, size, and market positioning. Residential cleaning services with high client turnover typically receive lower multiples than commercial cleaning companies with multi-year service contracts. Additionally, specialized cleaning niches with proprietary methods or exclusive territory rights might command premium valuations beyond standard industry multipliers. Professional business appraisers with specific cleaning industry experience can provide the most accurate valuations by considering regional market conditions, competitive landscape analysis, and industry-specific risk factors.

Negotiating the Asking Price When Buying a Cleaning Business

Effective negotiation begins with comprehensive understanding of how the seller arrived at their asking price for the cleaning business. Request detailed documentation supporting their valuation, including financial statements, client contracts, and asset inventories. Compare their asking price against industry benchmarks for similar cleaning companies in your region, recognizing that commercial cleaning operations typically command higher multiples than residential services. Identify specific business aspects that might justify adjusting the valuation, such as client concentration risks, aging equipment requiring imminent replacement, or contracts approaching renewal periods. Leverage these findings to develop a counter-offer supported by concrete data rather than arbitrary price reductions.

Beyond the headline purchase price, sophisticated buyers recognize that acquisition structure often matters more than the absolute valuation. Negotiate favorable terms including seller financing arrangements, which often indicate the seller’s confidence in the business’s future performance while reducing your immediate capital requirements. Consider performance-based earnouts that tie portions of the purchase price to client retention or revenue maintenance during the transition period, mitigating risk while potentially bridging valuation gaps. Address inventory adjustments and work-in-progress considerations to ensure you’re not overpaying for depleted cleaning supplies or prepaid contracts. Discuss transition assistance terms, including how long the seller will remain involved to facilitate client relationships and staff retention. Remember that cleaning businesses derive significant value from client relationships and staff.