Due-Diligence Checklist for Buying a Cleaning Company

Embarking on buying a cleaning business requires careful consideration and thorough investigation. A comprehensive due diligence checklist becomes your roadmap when considering buying a cleaning company, helping you uncover both opportunities and potential pitfalls. Whether you’re interested in a traditional cleaning business or a dry cleaning business, proper due diligence isn’t optional—it’s essential for any business buyer. This guide will walk you through the critical components of cleaning business due diligence, ensuring your acquisition proceeds with confidence and clarity. As a potential buyer, understanding the business’s operations, financials, and viability before finalizing any agreement will significantly impact your success.

For an in-depth analysis on how to buy a cleaning business be sure to read this guide.

What Is Due Diligence When Buying a Cleaning Business?

Why a Due Diligence Checklist Is Essential for Cleaning Business Acquisitions

Due diligence when buying a cleaning business involves a systematic investigation into all aspects of the company before finalizing the acquisition. This process helps the business buyer verify the financial and legal information provided by the seller and uncover any potential issues that might affect the business’s viability or valuation. A well-structured due diligence checklist serves as your protection against unexpected liabilities and problems that could emerge after the purchase is complete. Without proper due diligence, you risk investing in a cleaning business with hidden operational issues, financial discrepancies, or legal complications that could significantly impact your return on investment.

For potential buyers of cleaning companies, thorough due diligence represents the difference between a successful acquisition and a problematic investment. The cleaning industry has specific considerations that must be evaluated, from recurring service agreements to equipment condition and employee retention. Business brokers often emphasize that cleaning businesses require particularly careful scrutiny of customer contracts, as client retention directly impacts future cash flow. Additionally, the due diligence process allows you to validate the business’s financial statements against actual performance, ensuring the company genuinely delivers the profits claimed by the current business owner. This verification stage is especially critical when buying a dry cleaning business, where specialized equipment and environmental regulations add complexity to the evaluation.

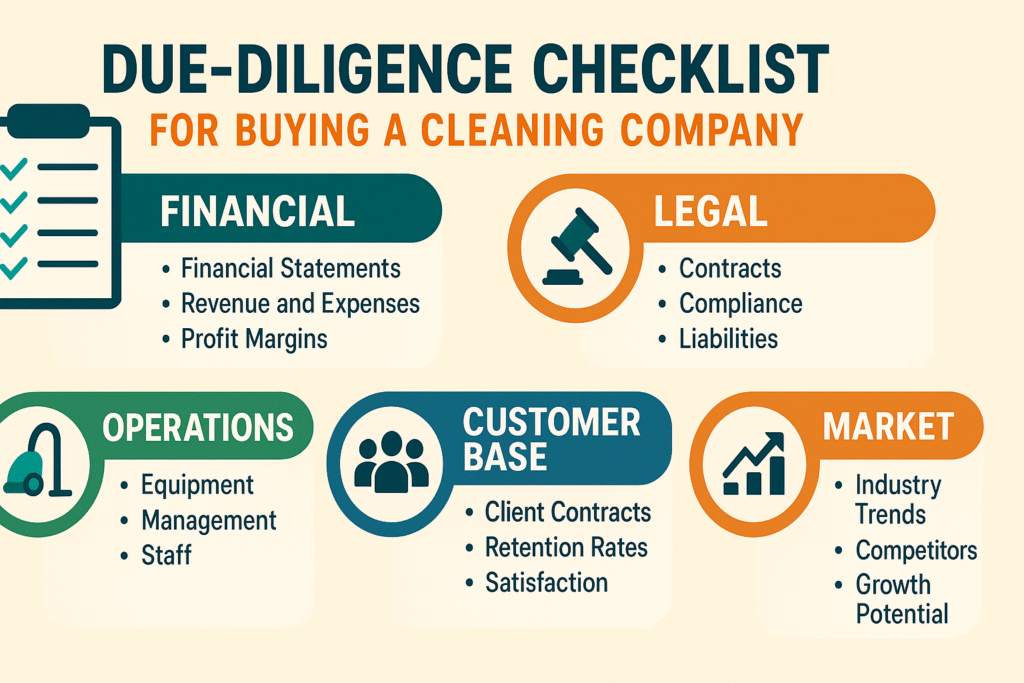

Key Components of a Thorough Cleaning Business Due Diligence Process

A comprehensive due diligence process for buying a cleaning business encompasses financial, operational, legal, and market aspects. Financial due diligence involves examining tax returns, profit margins, cash flow statements, and outstanding debts to verify the financial health of the business you’re considering. This critical step helps potential buyers understand the true earning potential of the cleaning company and identify any discrepancies in the financials presented by the seller, particularly regarding business expenses. Operational due diligence focuses on evaluating the efficiency of business operations, equipment condition, and the stability of key employees who maintain service quality and client relationships.

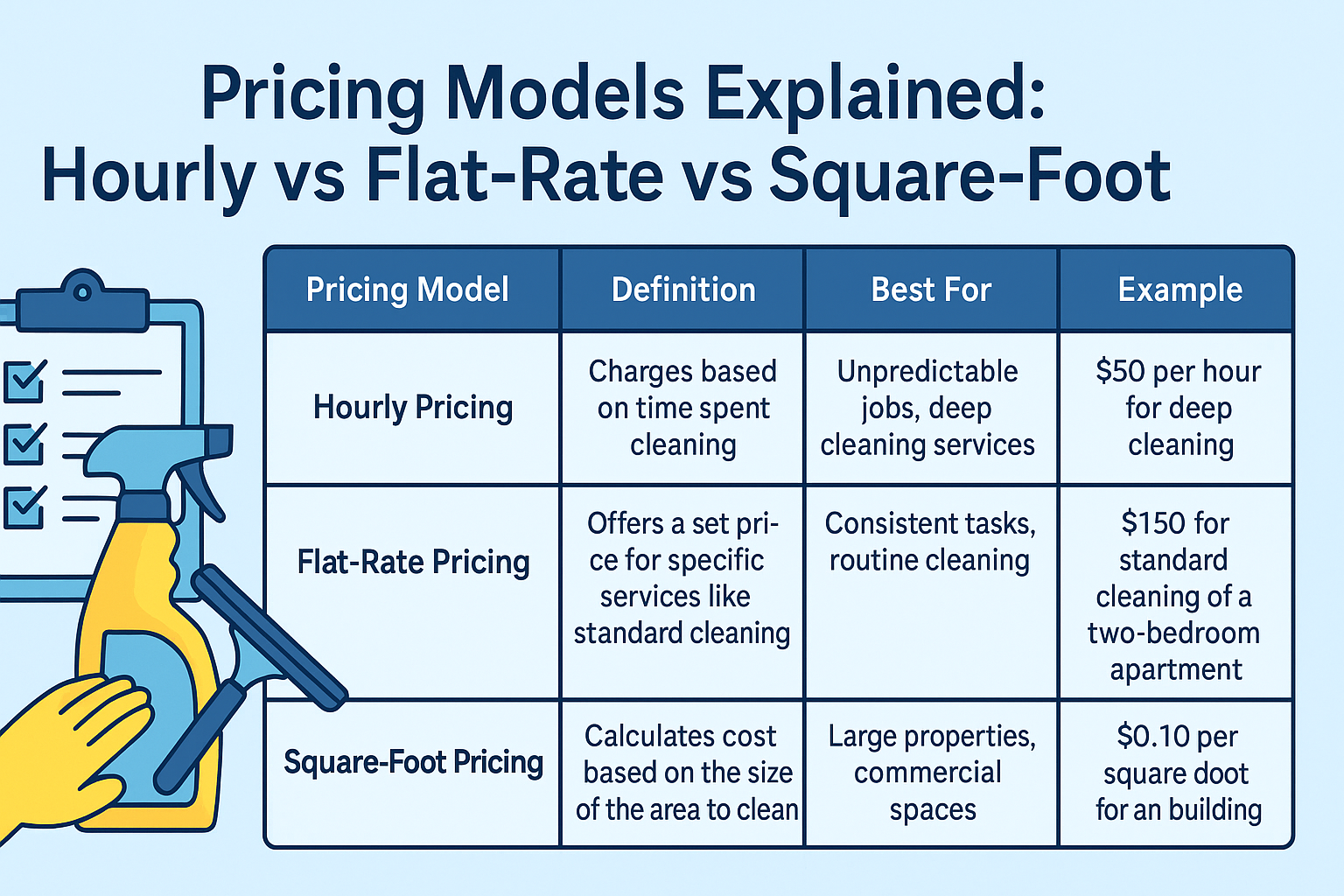

Legal due diligence requires scrutinizing all contracts, insurance policies, and potential liability issues before proceeding with the business acquisition. This includes reviewing lease agreements, service contracts, employment agreements, and compliance with industry regulations specific to the cleaning sector. A thorough examination of these legal aspects helps prevent unexpected issues after the purchase. Market due diligence involves analyzing the competitive landscape, customer satisfaction, and growth opportunities within the service area. Understanding the business’s market position gives the buyer insight into its sustainability and expansion potential. Commercial due diligence also examines the company’s products or services, pricing strategy, and market differentiation to determine long-term viability in an increasingly competitive cleaning industry.

Common Due Diligence Mistakes to Avoid

When buying a cleaning business, many potential buyers make critical mistakes during the due diligence process that can lead to problematic acquisitions. One common error is rushing through the checklist to close the deal quickly, which often results in overlooking significant financial and legal issues that could affect the business’s viability. Thorough due diligence isn’t a formality but a crucial protection mechanism for the buyer. Another frequent mistake is failing to verify financial statements independently, perhaps by not involving an accountant to analyze the tax returns and cash flow statements. This verification is essential because some business owners may present optimistic financials that don’t reflect the actual business performance.

Additionally, many buyers focus exclusively on financial due diligence while neglecting operational aspects of the cleaning business. Understanding day-to-day operations, employee satisfaction, and equipment condition is equally important for a successful transition. When buying a dry cleaning business specifically, overlooking environmental compliance and potential contamination liabilities can result in significant unexpected costs post-acquisition. Some buyers also fail to adequately assess the transferability of client relationships, assuming that customers will automatically remain with the business after ownership changes. A comprehensive due diligence checklist helps avoid these pitfalls by ensuring all critical aspects of the business acquisition are methodically examined before finalizing any agreement with the current business owner.

Financial Due Diligence: Examining the Numbers Before You Buy

Essential Financial Records to Review in Your Due Diligence Checklist

When conducting financial due diligence for buying a cleaning business, examining comprehensive financial records is paramount. Start by reviewing at least three years of financial statements, including income statements, balance sheets, and cash flow statements. These documents provide critical insights into the company’s financial health and performance trends over time. Tax returns should be compared with financial statements to verify consistency and identify any discrepancies that might raise concerns. A potential buyer should also analyze accounts receivable aging reports to understand customer payment patterns and potential collection issues that could affect cash flow after acquisition.

Beyond standard financials, your due diligence checklist should include examining payroll records, equipment depreciation schedules, and inventory valuation methods. Understanding how the current business owner has structured the company’s financials provides insights into the true operational costs. An accountant experienced in cleaning business acquisitions can help uncover normalized earnings by identifying owner benefits, one-time expenses, or accounting practices that might skew the financial picture. For a dry cleaning business specifically, financial due diligence should include analysis of equipment maintenance costs, chemical supplies expenses, and utility consumption, as these represent significant operational costs that impact profitability. Thorough examination of these financial records helps ensure the business’s valuation is justified and supports informed negotiation during the acquisition process.

Verifying Revenue Streams and Client Contracts

A critical component of due diligence when buying a cleaning business involves verifying revenue streams and examining client contracts. Start by categorizing revenue by client type, service frequency, and contract duration to understand the stability and diversity of income sources in the financials of the business. This analysis reveals whether the business relies too heavily on a few key clients, which creates vulnerability should those relationships change after acquisition. Carefully review all service agreements to confirm their transferability to a new business owner, as some contracts may contain clauses requiring client approval before ownership changes. The due diligence process should include verification of recurring revenue claims by examining bank statements and payment records to ensure reported income matches actual deposits.

For any business buyer, understanding client retention rates provides valuable insights into service quality and customer satisfaction. Request client history reports showing account longevity, service expansion, and price increases over time. This information helps assess the strength of client relationships that the business has built. When buying a dry cleaning business, examine retail customer frequency patterns and commercial account agreements separately, as these represent different revenue stability factors in the dry cleaning service. During your financial due diligence, pay particular attention to recent revenue trends, as declining income could indicate market saturation, increased competition, or service quality issues affecting customer loyalty. Additionally, verify that all represented contracts are current and in good standing by conducting sample client calls with the seller’s permission, which can provide confirmation of service satisfaction and continuation intentions under new ownership.

Analyzing Profit Margins and Operating Expenses

Thorough analysis of profit margins and operating expenses forms a crucial part of financial due diligence when buying a cleaning business. Begin by calculating gross and net profit margins for different service categories to identify the most profitable aspects of the business you’re considering. This analysis helps potential buyers understand which services drive profitability and which may require adjustment after acquisition. Compare the company’s profit margins against industry benchmarks to determine whether the business performs at, above, or below cleaning industry standards. Significant deviations require explanation and may represent either competitive advantages or operational inefficiencies that will affect your business plan after purchase.

Operating expense analysis should break down costs by category, including labor, supplies, equipment maintenance, insurance, rent, and administrative expenses. This detailed examination helps uncover whether the current business owner has been deferring necessary expenses to inflate profits temporarily or if there are opportunities for cost optimization under new management. When buying a dry cleaning business specifically, analyze chemical costs, utility expenses, and equipment maintenance as these represent significant operating costs unique to this industry. Your due diligence checklist should include verification of all major expense categories through invoice reviews and vendor confirmations. An accountant familiar with cleaning business operations can help identify unusual expense patterns or missing cost categories that might affect future profitability. This comprehensive financial due diligence provides the foundation for accurate business valuation and informs your negotiation strategy during the acquisition process.

Operational Due Diligence: What to Inspect in a Cleaning Business

Equipment and Supplies Assessment Checklist

When buying a cleaning business, a thorough equipment and supplies assessment is essential to understand the true operational value of the company. Your due diligence checklist should include a comprehensive inventory of all cleaning equipment, noting the age, condition, maintenance history, and replacement costs for each significant item. This evaluation helps identify potential capital expenditures you might face shortly after acquisition. For specialized cleaning businesses, verify that all equipment meets current industry standards and regulations. Equipment that requires imminent replacement or significant repairs should be factored into your valuation and possibly negotiated in the purchase agreement with the current business owner.

Supply management represents another critical aspect of operational due diligence when buying a cleaning company. Examine inventory levels, ordering systems, and supplier relationships to ensure continuity after the transition. Review supplier agreements to confirm transferability and verify whether the business receives competitive pricing on cleaning products or if better terms could be negotiated. When considering buying a dry cleaning business specifically, equipment assessment becomes even more critical due to the specialized nature and high replacement costs of dry cleaning machines. Inspect chemical storage facilities and waste disposal systems to ensure environmental compliance, as non-compliance could create significant liability issues post-acquisition. A complete operational assessment should also include evaluating the efficiency of the equipment relative to labor costs, as outdated equipment might be increasing labor expenses and reducing profit margins in ways not immediately apparent in the financial statements.

Evaluating Existing Staff and Management Structure

A critical component of operational due diligence when buying a cleaning business involves thoroughly evaluating the existing staff and management structure. Begin by reviewing organizational charts, job descriptions, and employee files to understand the workforce composition and identify key employees essential to business continuity. Examine staff retention rates, as high turnover can indicate management issues or uncompetitive compensation. Your due diligence checklist should include verification of proper employee classification (W-2 vs. 1099 contractors), compliance with labor laws, and confirmation that all required background checks have been performed, especially important in a cleaning business where staff often work in clients’ homes or businesses.

For a potential buyer, understanding the management structure provides insights into how the business operates without the current owner’s direct involvement. This assessment helps determine whether you’ll need to take an active operational role or if the existing management team can effectively run the business. Review compensation structures, bonus systems, and benefit packages to evaluate their competitiveness in retaining quality staff. When buying a dry cleaning business, assess specialized staff training and certifications required for operating equipment and handling chemicals. During your due diligence process, try to determine employee morale and satisfaction through confidential interviews if possible, as staff retention during ownership transition significantly impacts business continuity. Also examine training programs, operational manuals, and quality control systems that ensure consistent service delivery, as these elements contribute substantially to the business’s viability and smooth transfer of operations during the acquisition.

Reviewing Service Delivery Systems and Quality Control

Effective service delivery systems and quality control measures are fundamental to a cleaning business’s success and should be meticulously examined during the due diligence process. When buying a cleaning business, review the company’s standard operating procedures, service checklists, and quality assurance protocols to understand how consistency is maintained across different clients and cleaning teams. Evaluate the efficiency of scheduling systems, job assignment methods, and communication tools used between management, staff, and clients. These operational elements directly impact customer satisfaction and retention, making them crucial components of your customer due diligence checklist. Examine customer feedback mechanisms, complaint resolution procedures, and quality inspection records to assess service reliability.

For a business buyer considering a cleaning company acquisition, understanding how the business maintains service standards is essential for evaluating its long-term viability. Request data on service failures, client complaints, and remediation costs to identify potential operational weaknesses that might require improvement after purchase. When buying a dry cleaning business specifically, review quality control measures for garment processing, stain removal success rates, and damage claims history. The due diligence process should include observing actual service delivery when possible to verify that documented procedures match real-world execution. Additionally, evaluate the business’s use of technology in service delivery, such as digital checklist apps, GPS tracking, or customer portals, as these can provide competitive advantages or improvement opportunities. Understanding these operational systems helps the potential buyer assess whether the business can maintain quality standards during ownership transition and identifies areas where immediate operational changes might be necessary.

Legal Due Diligence: Protecting Your Investment

Contracts and Agreements to Scrutinize

Legal due diligence when buying a cleaning business requires thorough examination of all contracts and agreements that could affect business operations post-acquisition. Start by reviewing client service agreements, paying special attention to termination clauses, automatic renewal provisions, and transferability in case of ownership change. Some contracts may require client approval before assignment to a new business owner, which could impact revenue stability during transition. Vendor and supplier agreements should be scrutinized to understand commitments, pricing structures, and termination options. Your due diligence checklist must include reviewing any equipment lease agreements, as these represent ongoing financial obligations that will transfer with the business acquisition and could significantly impact cash flow.

Employment contracts and non-compete agreements with key employees demand careful evaluation during the due diligence process when you’re buying a business. These documents help protect the business’s client relationships and operational knowledge but must be properly structured to be enforceable. When buying a dry cleaning business specifically, examine any specialized service agreements for commercial clients or garment restoration services. Property lease agreements require particular attention, as they often represent significant long-term commitments and may contain restrictive clauses or renewal terms that could affect business viability. A potential buyer should also review any existing business loans, lines of credit, or equipment financing agreements to understand ongoing debt obligations. Franchise agreements, if applicable, need special scrutiny to verify transferability and ongoing royalty or fee requirements. A comprehensive legal due diligence helps ensure you understand all contractual obligations before finalizing the purchase agreement with the current business owner.

Compliance and Regulatory Checklist Items

Comprehensive legal due diligence for buying a cleaning business must include a thorough assessment of regulatory compliance across multiple domains. Begin by verifying that the company maintains all required business licenses, permits, and certifications specific to cleaning services in their operational jurisdictions. This verification is particularly critical if the business provides specialized cleaning services that require specific certifications or if it operates across multiple municipalities with varying requirements. Review compliance with employment regulations, including proper worker classification, I-9 verification, and adherence to wage and hour laws. Your due diligence checklist should include confirmation of proper insurance coverage, including general liability, workers’ compensation, automobile insurance for company vehicles, and any specialized coverage required for the specific cleaning services offered.

Environmental compliance becomes especially significant when buying a dry cleaning business due to the chemicals used in operations. Examine environmental permits, chemical handling procedures, waste disposal practices, and any history of violations or remediation requirements. For any cleaning business acquisition, verify compliance with OSHA regulations regarding employee safety, chemical handling, and required safety training. The due diligence process should include reviewing tax compliance, including sales tax collection and remittance procedures if applicable to the cleaning services provided. A potential buyer must also assess compliance with customer data protection regulations if the business maintains client payment information or other sensitive data. Non-compliance in any of these areas could create significant liability issues that might not be immediately apparent in financial statements. Working with legal counsel experienced in cleaning business acquisitions can help identify compliance gaps that should be addressed before finalizing the purchase agreement with the current business owner.

Identifying Potential Legal Liabilities

Identifying potential legal liabilities forms a crucial part of due diligence when buying a cleaning business. Begin by conducting a thorough search for any pending or threatened litigation against the company, including customer complaints, employee disputes, or vendor conflicts. Review the business’s history of insurance claims, particularly those related to property damage, employee injuries, or vehicle accidents, as these can indicate operational issues and affect future insurance costs. Your due diligence checklist should include examining any past settlements or judgments against the business to understand the nature of previous legal issues and whether similar liabilities might recur under new ownership. The business buyer should also review warranty commitments and service guarantees that might create obligations extending beyond the acquisition date.

When buying a dry cleaning business specifically, environmental liability requires particular scrutiny due to the potential for soil or groundwater contamination from cleaning chemicals. Historical environmental assessments, testing reports, and compliance records should be carefully reviewed, as cleanup costs for contaminated properties can far exceed the business’s purchase price. For any cleaning business acquisition, it is essential to review indemnification clauses in contracts that might transfer liability to the new owner. Examine intellectual property ownership, including branding, logos, websites, and client databases to ensure the business has clear rights to use all assets being transferred. Additionally, confirm there are no unresolved issues related to zoning laws, building code violations, or regulatory audits. If the cleaning company subcontracts part of its services, review the contracts and liability waivers in place to ensure you’re not inadvertently assuming third-party risks.

Engaging a business attorney who specializes in acquisitions will help you identify and mitigate potential legal pitfalls during the due diligence process. Uncovering liabilities early can provide leverage in negotiations or even serve as a deal-breaker if risks are too great.

Final Due Diligence Tips Before You Buy

Buying a cleaning business is a major investment that requires more than a quick glance at the books. The due diligence process is your opportunity to look under the hood of the business and validate whether the purchase will support your long-term financial and operational goals. Here are some final tips:

-

Don’t rush – Take the time to dig deep into every aspect of the business, especially the client base and service operations.

-

Get professional support – Engage accountants, attorneys, and possibly a business broker to ensure nothing is overlooked.

-

Ask for seller transparency – A serious seller should be willing to provide complete documentation and answer detailed questions.

-

Assess post-sale transition plans – Discuss how the seller will assist with the handover, including training, client introductions, and vendor transitions.

The more thorough your due diligence, the greater your confidence will be that the business you’re buying is worth the price—and the effort.

Ready to Buy a Cleaning Business?

If you’re serious about buying a cleaning company that’s already generating revenue, has trained staff in place, and comes with established contracts—you’re in the right place. At BuyCleaningBusiness.com, we help aspiring business owners skip the risky startup phase and acquire profitable cleaning businesses across the U.S.

Don’t waste months building from scratch when you can buy a turnkey operation with immediate cash flow.